Ensuring accurate IAS 19 Valuations is essential for your organization's financial health.

Prima Consulting delivers precise valuations for Employee Benefits Accounting, Pension Valuation, and Defined Benefit Plans to businesses in Saudi Arabia, UAE, and Pakistan.

IAS 19 is crucial for financial reporting, ensuring transparency and consistency in recognizing employee benefits.

This standard helps stakeholders understand the financial impact of employee benefits on an organization.

Employee benefits refer to all forms of consideration an entity gives in exchange for services rendered by employees. IAS 19 categorizes these benefits into four primary types:

Benefits are expected to be settled wholly within 12 months after the end of the reporting period in which the employees render the related service.

Examples: wages, salaries, social security contributions, paid annual leave, and non-monetary benefits (such as medical care, housing, and cars).

Benefits payable after the completion of employment, including pensions and other retirement benefits.

These can be funded or unfunded. Funded plans have plan assets set aside in a separate legal entity to pay the benefits.

Benefits are not expected to be settled wholly before 12 months after the end of the period the employees render the related service.

Examples: long-service leave, long-term disability benefits, profit-sharing, and bonuses payable 12 months or more after the reporting period.

Benefits payable as a result of an entity's decision to terminate an employee's employment before the expected retirement date or an employee's decision to accept voluntary redundancy.

Examples: severance payments, lump-sum payments, enhanced retirement benefits.

Defined Benefit Plans are post-employment benefit plans where the employer promises a specified monthly benefit upon retirement, typically based on salary and years of service.

These plans require detailed actuarial calculations to estimate future obligations.

Defined Benefit Plans provide a predetermined benefit amount upon retirement, typically calculated based on a formula involving the employee's earnings history, tenure of service, and age.

Employers are responsible for ensuring enough plan assets to meet future benefit payments, requiring careful financial planning and regular actuarial valuations.

Setting actuarial assumptions is complex, as it involves estimating future events such as salary increases, employee turnover, and life expectancy. Economic conditions can also impact these valuations significantly.

Compliance with IAS 19 and regional regulations in Saudi Arabia, UAE, and Pakistan is essential. Understanding and adhering to these standards ensures accurate and legally sound financial reporting.

Accurate IAS 19 Valuations ensure that employee benefit obligations are correctly reflected in financial statements, providing an accurate picture of a company's financial health.

Proper valuations help identify and mitigate financial risks associated with employee benefits, ensuring long-term stability.

Detailed valuations provide insights that support strategic decisions regarding benefit plans, helping organizations optimize costs and benefits.

Defined Benefit Plan Valuations: We conduct actuarial valuations for defined benefit pension plans, EOSB, and graduaty, calculating the present value of defined benefit obligations (DBO).

Post-Employment Benefits: Valuations for post-employment medical benefits, gratuity, and similar benefits.

Other Long-Term Employee Benefits: Valuation of long-term benefits like long service awards, jubilee benefits, and deferred compensation.

Setting Actuarial Assumptions: We determine assumptions for discount rates, salary growth, mortality rates, and employee turnover, performing scenario analysis and sensitivity testing.

Experience Studies: We analyze historical data to refine actuarial assumptions and update them based on the latest trends.

Financial Statement Preparation: Assistance in incorporating IAS 19 valuations into financial statements, ensuring accurate reflection of employee benefit obligations.

Disclosure Requirements: Preparation of detailed disclosures required under IAS 19, with guidance on presenting employee benefits in financial statements.

Compliance Reviews: Ensuring compliance with IAS 19 and other relevant standards, identifying and addressing gaps.

Audit Support: Assistance during external audits of IAS 19 valuations, providing necessary documentation and explanations to auditors.

Plan Design and Optimization: Advice on designing and restructuring employee benefit plans, with strategies to optimize costs and benefits.

Risk Management: Identifying and mitigating financial risks associated with employee benefits and developing strategies to manage these risks.

Mergers and Acquisitions: Valuation of employee benefit obligations during M&A transactions and integration of benefit plans post-merger.

Employee Training: Workshops and training sessions for HR and finance teams on IAS 19 compliance and regulatory updates.

Management Briefings: Briefings for senior management on the financial implications of employee benefits, offering strategic insights for decision-making.

Tailored Valuation Models: Development of customized actuarial models specific to client needs, providing flexible solutions for unique employee benefit structures.

Our team boasts deep expertise in IAS 19 Valuations, delivering precise and reliable actuarial services to help businesses meet their financial reporting needs.

We provide custom solutions tailored to the specific needs of businesses in Saudi Arabia, UAE, and Pakistan, ensuring optimal results.

Ensuring full compliance with IAS 19 and other relevant standards, we help you achieve accurate financial reporting and seamless audit processes.

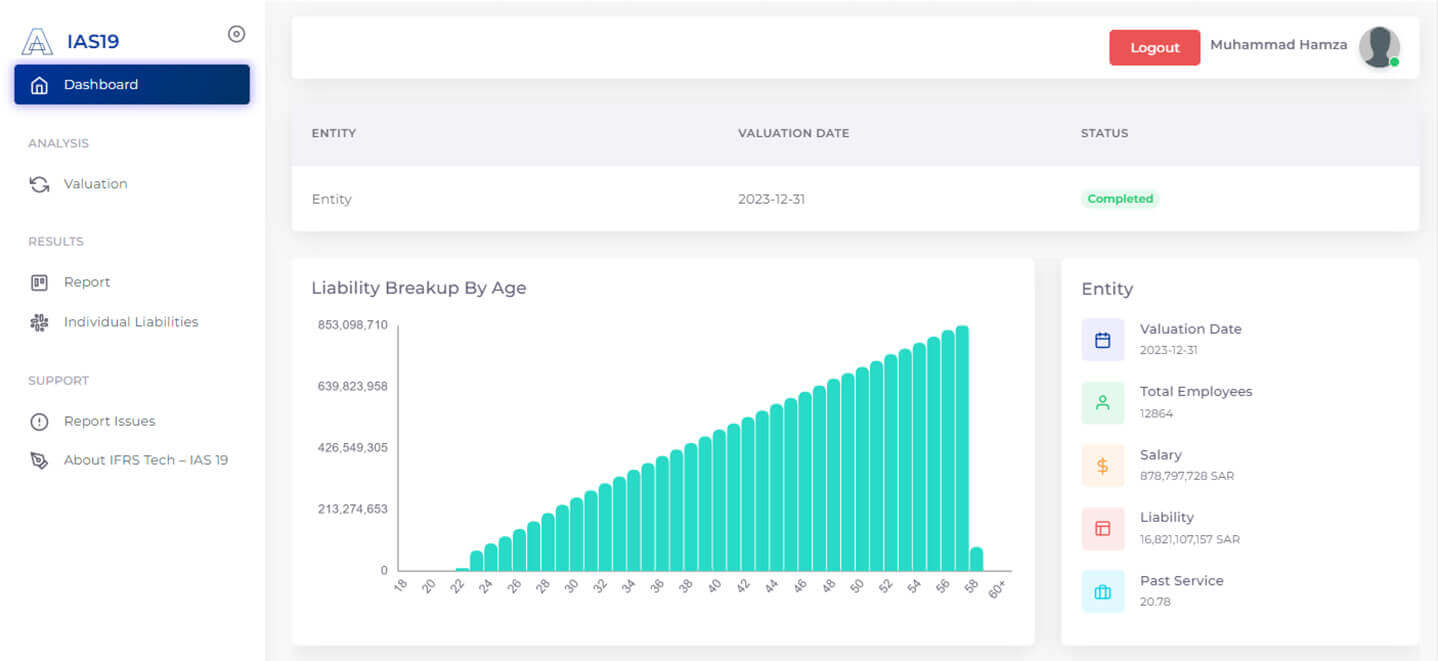

Prima Consulting offers a state-of-the-art IAS 19 valuation suite designed to streamline the valuation of End of Service Benefits (EOSB), Gratuity, and Defined Benefit Lumpsum Payments.

Our tool ensures compliance with IAS 19, enhancing accuracy and efficiency in pension accounting.

An IAS 19 actuarial valuation comprehensively assesses a company's financial obligations from employee benefits. It involves calculating the present value of future payments for pension plans, post-employment healthcare, and other long-term benefits. By conducting a rigorous IAS 19 valuation, organizations can accurately measure their pension liabilities, manage financial risks, and comply with international accounting standards.

Actuarial valuations are complex calculations requiring specialized expertise. The process involves gathering detailed employee data, making assumptions about future factors like salary increases, retirement ages, and mortality rates, and applying sophisticated actuarial models. The outcome is a precise estimate of the present value of future benefit obligations, providing valuable insights for financial planning and decision-making.

IAS 19 establishes clear criteria for recognizing liabilities and expenses related to employee benefits. A liability arises when an employee renders service in exchange for future benefits. The corresponding expense is recognized as the entity consumes the economic benefits of the employee's service. Applying IAS 19 recognition principles ensures accurate financial reporting and compliance with international accounting standards.

While IAS 19 provides a robust framework for accounting for employee benefits, it also has certain limitations. For instance, the standard restricts the recognition of asset surpluses arising from defined benefit plans. Additionally, the complexity of actuarial assumptions and calculations can introduce uncertainties in the valuation process. Prima Consulting's expertise can help you navigate these challenges and maximize the benefits of IAS 19.

The core principle underpinning IAS 19 is that the cost of employee benefits should be recognized when the employee earns the benefit rather than when the payment is made. This matching concept ensures a more accurate reflection of the company's financial performance. Adhering to this principle is crucial for maintaining financial statement reliability and comparability.

A settlement under IAS 19 occurs when a company eliminates its legal or constructive obligation for a portion or all of the benefits provided under a defined benefit plan. This typically involves a lump-sum cash payment to plan members. Settlements can have significant financial implications, and proper accounting treatment is essential to reflect the transaction's impact on the financial statements accurately.

IAS 19 encompasses many employee benefits, including short-term benefits like salaries and wages, long-term benefits such as pensions and post-employment healthcare, and termination benefits. The standard provides comprehensive guidance on accounting and disclosure requirements for these benefits, helping organizations present a clear and accurate picture of their financial position.

Termination benefits are payments or other forms of compensation provided to employees when their employment ends. These benefits include severance pay, accrued unused vacation pay, and other contractual entitlements. IAS 19 outlines specific criteria for recognizing and measuring termination benefits, ensuring consistent and comparable financial reporting.

Calculating final settlement involves determining an employee's final salary, including regular earnings, bonuses, overtime pay, and accrued leave. Deductions for loans, advances, or other liabilities are also considered. The final settlement amount forms the basis for calculating termination benefits and other related payments, ensuring accurate and fair compensation for the employee.

Your Trusted Partner for Financial & Risk Management Solutions in the MENA Region