Financial Reporting Software for Effective Interest Rate (EIR) calculations Automate EIR workflows, speed up financial reporting, and simplify audits with ARK9.

The automated engine of our IFRS 9 compliance software runs Effective Interest Rate calculations at origination and every revaluation date. It tracks principal, interest, re-payments and deferred acquisition cost / revenue at portfolios, sub-portfolios, and facilities without spreadsheet errors. Scenario testing helps compare standard and stressed interest flows. The system aligns to the effective interest rate method IFRS 9 and minimizes manual data risk. With accurate calculations, you reduce volatility in asset income streams and strengthen financial modeling integrity.

Capture acquisition costs like commissions and fees during initial recognition. Amortize DAC using the same EIR applied to the instrument. This EIR calculation software generates ready-to-export schedules for mapping to balance sheets and income statements. This reduces reconciliation work and adds consistency across your financial reporting software for IFRS 9.

Connect to SAP, Oracle, Microsoft, or any core system using REST APIs, SOAP, or WebSocket.

ARK9 pulls loan and investment data, forecasts, and actuals in real time.

Built-in validations help catch issues before loading. The API-first design creates a unified platform for reporting, dashboards, and governance.

Whether on-prem, hybrid, or multi-cloud, ARK9 IFRS 9 compliance software delivers performance across portfolio sizes.

Built to support financial institutions managing high-volume data, the tool includes access control, export logs, and real-time tracking.

It adapts with your growth and provides flexibility needed for banking regulations and changing operational requirements.

Maintain full version control, action logs, and scenario history for every step.

ARK9 produces regulator-ready reports and parameter documentation.

Track all user changes and maintain consistent data lineage. This strengthens compliance frameworks and reduces costs during external reviews.

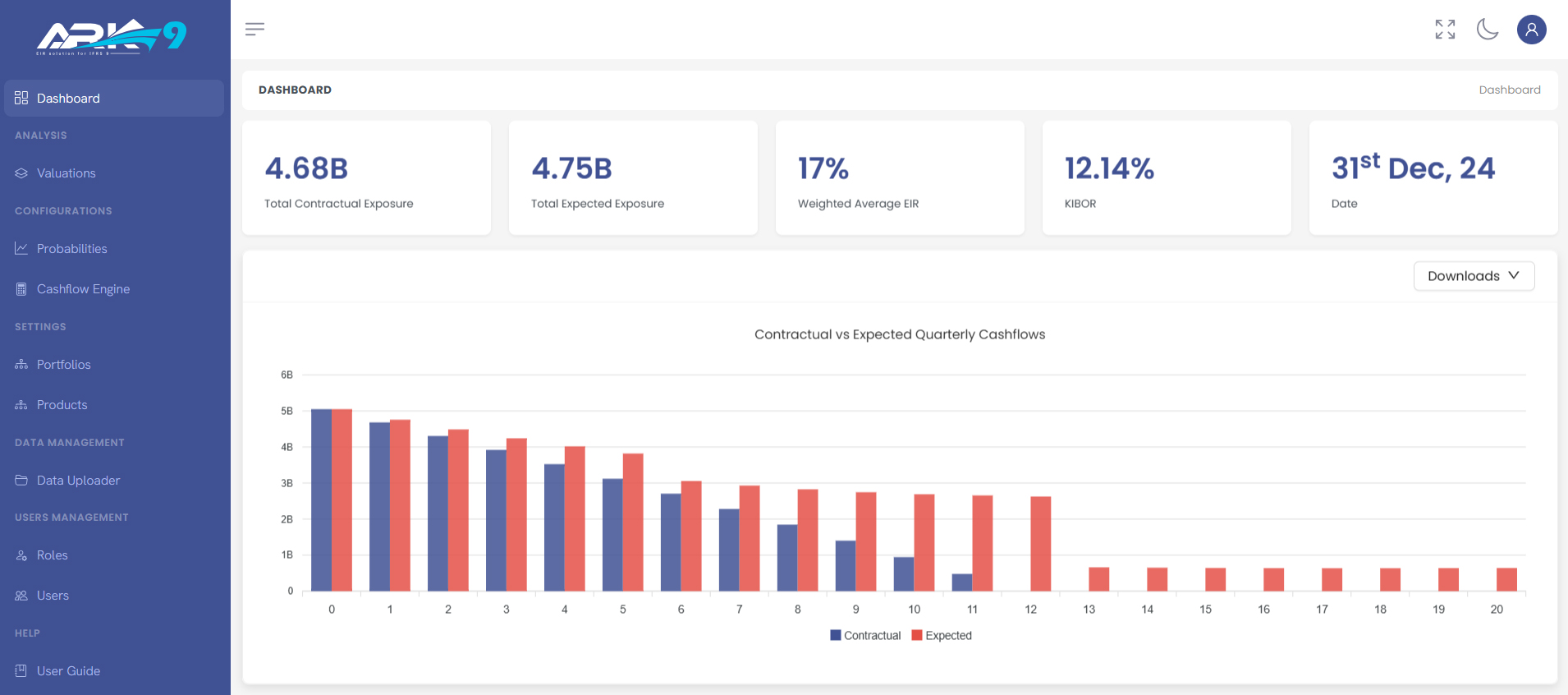

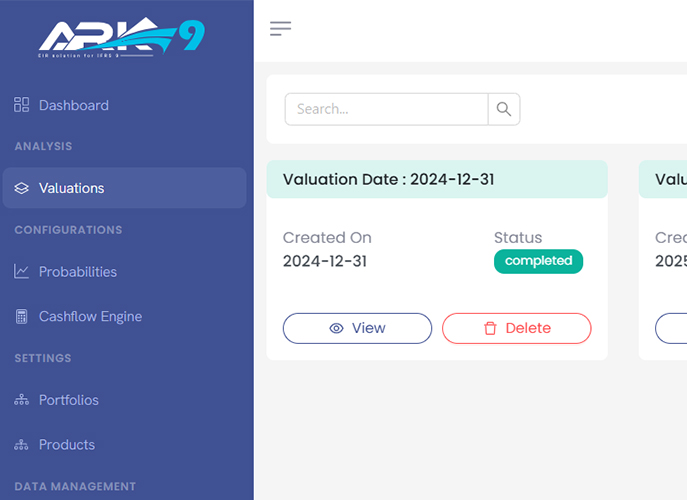

Dashboards show top-level KPIs with drilldowns into individual facilities.

Exports support Excel, board packs, or regulatory formats. Visuals are configurable and always audit-ready.

Clear insights improve decision-making, especially for finance teams monitoring interest rate risk and capital usage.

Gathers loan registers, investment data, cash flow forecasts, expected and actual cash flows, and initial recognition details in a unified platform.

This method applies probabilistic models, probabilities of default, and macroeconomic factors to create forward-looking cash flow generation scenarios.

Runs the effective interest rate IFRS 9 method with acquisition cost and revenue adjustments,.

Watches movements in principal, interest, deferred acquisition cost and deferred balances for precise interest income and expense calculations.

This service saves data for regulatory reporting, audit requests, and exports to dashboards, Excel, or PowerPoint board packs with full data traceability.

API-first SaaS design links to SAP, Microsoft, Oracle, Kepler IFRS, and member systems via REST API, SOAP, or Web Sockets—secure, hybrid, and multi-cloud ready with role-based access and MFA.

The Effective Interest Rate (EIR) under IFRS 9 is the rate that exactly discounts future cash flows to the asset’s gross carrying amount or the liability’s amortised cost. It reflects:

You derive the Effective Interest Rate (EIR) by solving for the rate that equates: Purchase price + Deferred balances = Present value of expected (recovery) cash flows Steps to follow:

The Effective Interest Rate (EIR) method amortises discounts or premiums on financial assets or liabilities. You apply it by:

The Effective Interest Rate (EIR) reflects the true cost of borrowing or lending over a period. It differs from the nominal rate by:

The EIR method differs from the nominal rate in key ways:

Per annum (APR) states the yearly cost without compounding. EIR shows the actual annual cost after accounting for compounding, fees and charges. EIR gives a clearer picture of income on lending and investment portfolios and borrowing cost under IFRS 9 standards.

Banks solve for the rate that discounts all contractual cash flows, fees, and costs to the initial loan amount. Typical steps include:

Per annum (APR) states the yearly cost without compounding. EIR shows the actual annual cost after accounting for compounding, fees and charges. EIR gives a clearer picture of income on lending and investment portfolios and borrowing cost under IFRS 9 standards.

You can automate the Effective Interest Rate (EIR) calculation using an IFRS 9 automation tool that:

The best IFRS 9 EIR automation tool combines:

The Effective Interest Rate (EIR) method is a technique that:

Cloud-based IFRS software for IFRS 9 EIR Accounting offers:

Look for a tool that offers:

ARK9 is a cloud-based financial reporting software designed to automate Effective Interest Rate (EIR) calculations under IFRS 9 standards:

ARK9’s automated EIR engine:

ARK9 features an API-first design to pull data in real time:

ARK9 is purpose-built for IFRS 9 standards and banking regulations, featuring:

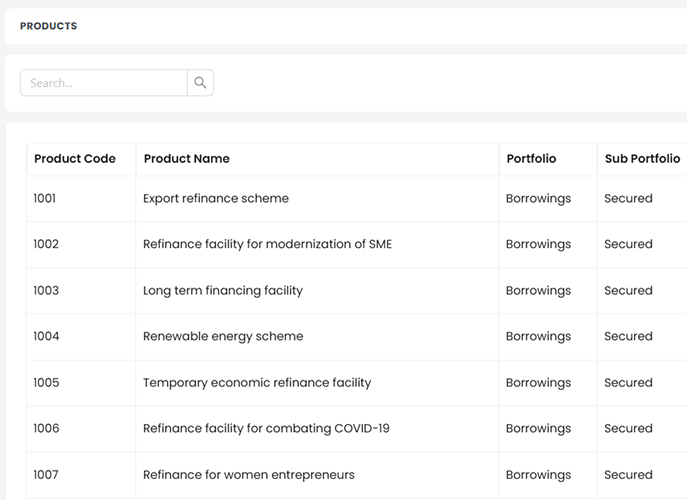

ARK9 supports a variety of financial products and valuation capabilities, including:

ARK9’s EIR solution also:

ARK9 provides comprehensive reporting and controls with:

ARK9 deployment options and performance features include:

ARK9 offers streamlined implementation benefits:

ARK9 is ideal for:

Your Trusted Partner for Financial & Risk Management Solutions in the MENA Region