Unlock seamless IFRS 17 implementation with Prima Consulting's Delta IFRS 17 software – the ultimate IFRS 17 solution designed specifically for the insurance industry in Saudi Arabia, UAE, Pakistan, and other regions.

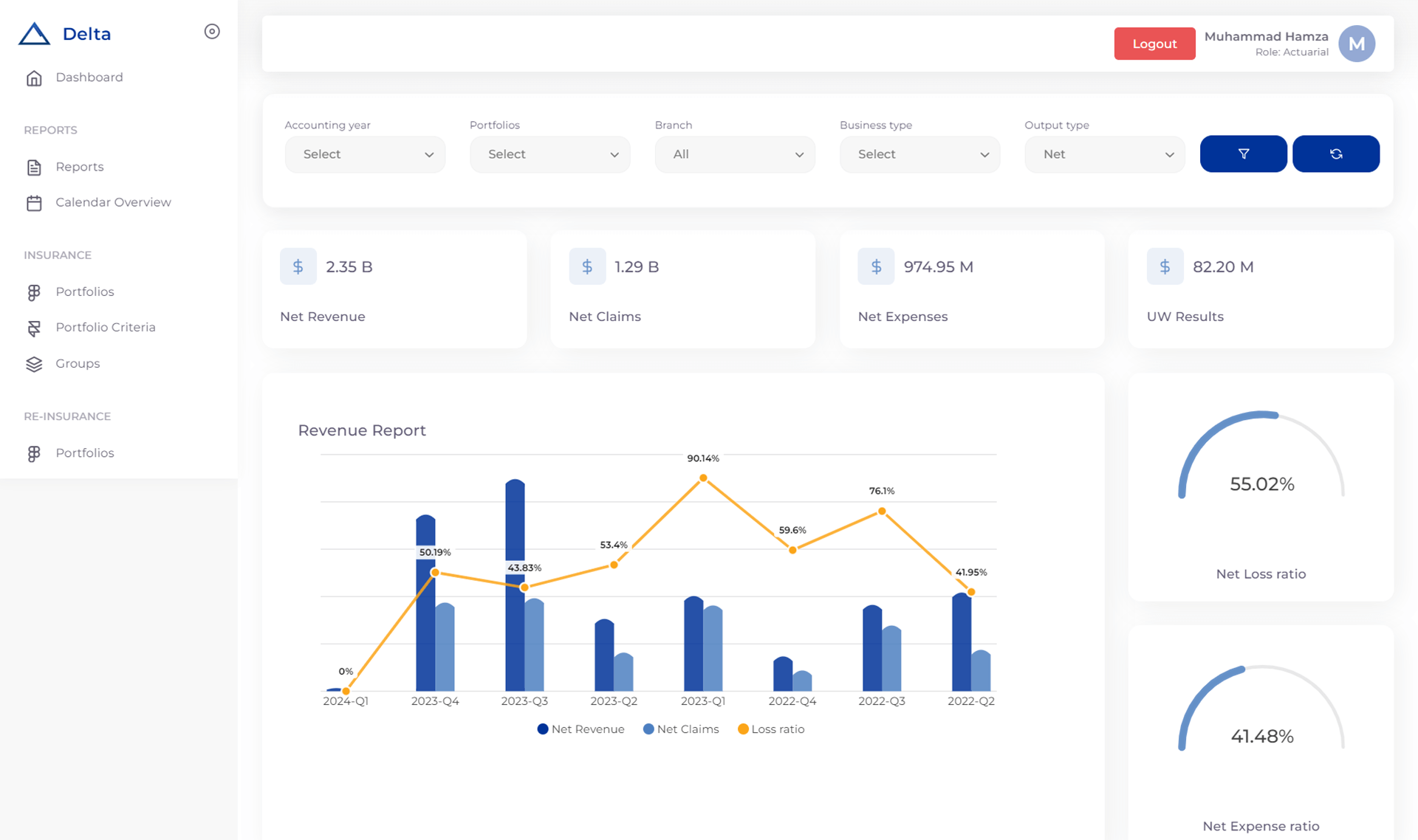

Delta IFRS 17 software advanced actuarial module performs complex calculations effortlessly, generating future cashflows, risk adjustments, and discounting.

This module ensures that your actuarial calculations are accurate, consistent, and reliable, providing a solid foundation for your financial reporting.

Moreover, you get the flexibility to run multiple scenarios, allowing you to evaluate the financial implications of vital actuarial accounting assumptions in real-time.

Our applications comprehensive accounting module accommodates IFRS 17 compliance, manages your entire corporate ledger with a flexible chart of accounts, and empowers real-time decision-making.

With your very own accounting software generate various management reporting packs, create complete financial statements (including non-IFRS 17 disclosures), and extract general ledger statements for any date – all with instant P&L and balance sheet updates.

This unified solution provides a holistic view of your financial health and grants unparalleled control.

Our IFRS 17 compliance tool is one of the best SAS solution IFRS options leveraging Amazon AWS's power.

It stands out as a highly effective option for insurance companies, offering a seamless and flexible experience with no need for hardware or client-side installations.

This allows for easy access, smooth processing, scalability, and reduced IT overhead, making it an ideal choice for insurance companies looking to modernize their operations.

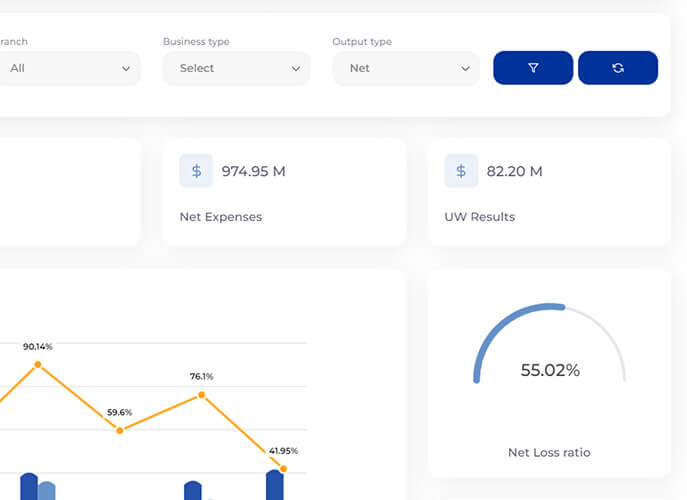

Our application comes with a comprehensive data analytics module which offers a wide range of powerful capabilities that allow for the in-depth analysis of real-time business data.

This sophisticated feature equips management with the tools to derive valuable insights promptly, enabling them to make well-informed decisions swiftly.

Ultimately, this empowers your business to maintain a competitive edge and stay ahead of the curve in today's dynamic market landscape.

Delta IFRS software has established a comprehensive data validation system to meticulously confirm the precision and reliability of all incoming data.

This sophisticated system is designed with a state-of-the-art automatic error detection feature that swiftly identifies any discrepancies and offers tailored suggestions for adjustments.

By doing so, it minimizes the likelihood of errors, which ultimately enhances the reliability and credibility of financial reporting.

IFRS

Being one of the best insurance reporting software on the market, Delta ensures the highest level of data security with geo-restrictions, IP restrictions, end-to-end SSL encryption, and secure deployment on a private cloud.

The system features tailored role-based access control, providing specific permissions for different user roles, ensuring that each user has access only to the necessary information and functions.

In addition, a comprehensive audit trail is implemented, enabling a detailed record of all system activities, including user interactions, data access, and changes made to the system.

Delta IFRS 17 Software provides an extensive audit trail feature that meticulously logs and tracks every action performed within the system.

This includes recording the individuals responsible for initiating the provisions, approving them, and managing the upload and approval of data.

The transparency offered by this audit trail is instrumental in upholding accountability and ensuring strict adherence to the standards outlined in the IFRS 17 regulations.

Our IFRS 17 compliance tool's file upload feature allows users to conveniently upload a single file or multiple files simultaneously.

The platform is equipped with built-in data validation functionality to guarantee the accuracy of the results.

In addition, automatic error detection and correction suggestions are readily available to streamline data management, minimize the chance of errors, and improve overall efficiency.

IFRS 17, introduced by the International Accounting Standards Board in May 2017, replaces IFRS 4 for insurance contract accounting. The IFRS 17 implementation date was January 1, 2023, after an initial planned start date of January 1, 2021. This IFRS 17 summary highlights the shift towards more transparent and consistent financial reporting in the insurance industry. If you are seeking an external software for your ifrs17 compliance project, Delta IFRS 17 software is right up your alley!

IFRS 17 requires insurance companies to measure their insurance contracts using specific financial models like the general measurement model (GMM), the premium allocation approach (PAA), or the variable fee approach (VFA). It also emphasizes the need for accurate cash flow projections, risk adjustment calculations, and CSM tracking. Robust systems and software, such as an IFRS 17 compliance tool, are essential for fulfilling disclosure requirements and maintaining an audit trail. Prima Consulting provides tailored solutions to help you meet these requirements effectively.

IFRS 17 is principle-based, offering flexibility in calculation methods. Companies can choose from four approaches to compute risk adjustment: the cost of capital approach, value at risk approach, scenario value at risk approach, and the margin for adverse deviation approach. Each method aims to meet the standard's rigorous data requirements for actuarial accounting.

When comparing IFRS 4 vs IFRS 17, the primary difference lies in transparency and consistency. IFRS 17 enhances comparability by standardizing revenue recognition and liability valuation accounting treatments. This new IFRS solution addresses the inconsistencies and subjective interpretations prevalent under IFRS 4.

The IFRS 17 calculation involves determining the present value of future cash flows for each contract group. This best estimate is part of a value-at-risk (VaR) calculation. A stress test and correlation approach adds margins to various assumptions to derive the required figures.

Yes, IFRS 17 is mandatory for insurance companies in jurisdictions that have adopted these standards. It ensures consistent and reliable financial reporting starting from January 1, 2023. Companies must restate comparatives for the previous reporting period, ensuring full IFRS 17 compliance.

IFRS 17 creates a unified framework for insurance contract accounting, simplifying comparisons across markets. This standard benefits investors and analysts by providing a clear and consistent basis for evaluating and benchmarking the performance of insurance companies worldwide.

In IFRS 17, the Risk Adjustment represents the compensation an entity requires for bearing uncertainty in the amount and timing of cash flows from non-financial risk as it fulfils insurance contracts. This element is crucial across all IFRS 17 models, including PAA and GMM.

IFRS 17 mandates the use of updated estimates and assumptions to measure insurance contracts, reflecting cash flow timing and related uncertainties. This leads to more transparent reporting of a company's financial position and risks, aligning with the overall objective of the IFRS 17 tool Tech Solutions.

Key principles of IFRS 17 include recognizing profits as insurance services are delivered rather than when premiums are received. The standard also requires disclosing information about expected future profits from insurance contracts, ensuring transparency and reliability.

IFRS 17 employs a measurement model that includes the present value of future cash flows, a risk adjustment, and a contractual service margin. There are three approaches for different insurance contracts: the general model, the Premium Allocation Approach (PAA), and the Variable Fee Approach (VFA).

Regarding IFRS 17 compliance, Prima Consulting Delta's IFRS 17 software excels. It supports the Premium Allocation Approach (PAA) and the General Measurement Model (GMM), offering flexibility for various insurance contracts. PAA amortizes the premium over time to the P&L, while GMM uses a forward-looking method, considering assumptions impacting cash flow expectations, discount rates, and risk adjustments. This comprehensive support for IFRS 17 PAA vs GMM calculations enables informed decision-making based on specific needs.

IFRS 17 compliance means ensuring your insurance company meets all the regulatory requirements outlined in the IFRS 17 accounting standard. This involves aligning your accounting systems, processes, and reporting frameworks with the standard's requirements. Comprehensive compliance includes adapting systems like insurance reporting software and implementing contractual service margin (CSM) automation to ensure accurate financial disclosures and seamless reporting. Prima Consulting offers expert guidance and IFRS 17 solutions to streamline your compliance journey.

The IFRS 17 risk adjustment can be negative if the expected outcomes indicate a net reduction in uncertainty regarding future cash flows. A negative risk adjustment reflects a situation where the variability in cash flows leads to favorable risk outcomes for the insurer. Accurate calculations using advanced IFRS 17 tools and software are essential for precise reporting. Prima Consulting's actuarial experts assist in determining risk adjustments with precision, ensuring compliance and clarity in your financial statements.

IFRS 17 fundamentally transforms how insurance companies measure, report, and manage financial performance. It introduces standardized measurement models for insurance contracts, enhancing transparency and comparability. However, significant changes in systems, processes, and data management are also required to ensure compliance. With Prima Consulting's IFRS 17 solutions, including implementation support and expert insights, insurance companies can navigate these changes efficiently while maintaining regulatory compliance.

Auditing IFRS 17 involves verifying that the insurance company's financial reporting meets the standard's requirements. This includes reviewing data preparation processes, CSM calculations, cash flow models, and disclosures. An effective audit requires robust systems, such as an IFRS 17 tool, and a clear audit trail to trace calculations and adjustments. Prima Consulting provides expert insights and systems to support seamless IFRS 17 audits, ensuring your reports withstand scrutiny.

The Contractual Service Margin (CSM) under IFRS 17 is calculated as the unearned profit of an insurance contract, adjusted for changes in cash flows, risk adjustments, and fulfillment cash flows. The calculation involves using specialized software solutions and financial modeling techniques to ensure accuracy. Prima Consulting's IFRS 17 compliance tools and expert guidance simplify this process, helping companies calculate and manage their CSM accurately.

IFRS 17 was introduced in May 2017 by the International Accounting Standards Board (IASB) and took effect on January 1, 2023. It replaces IFRS 4 and establishes a unified global standard for insurance contract accounting. Companies worldwide, including those in the Middle East, now rely on IFRS 17 solutions to meet these new requirements.

The Contractual Service Margin (CSM) represents the unearned profit of an insurance contract under IFRS 17. It is a critical component of the measurement model and ensures that profits are recognized over the coverage period of the insurance contract. Managing CSM accurately requires advanced tools like contractual service margin automation software. Prima Consulting offers tailored IFRS 17 solutions to streamline CSM management.

IFRS 17 is primarily designed for insurance companies to provide a consistent framework for measuring and reporting insurance contracts. However, other entities offering insurance-like products may also need to comply. Prima Consulting provides expert IFRS 17 solutions to assist companies in meeting their specific compliance needs.

Prima Consulting supports IFRS 17 compliance by offering end-to-end solutions, including insurance reporting software, contractual service margin automation, and expert actuarial services. Our tailored approach ensures that your systems, processes, and disclosures align seamlessly with the standard. Whether implementing an IFRS 17 tool or providing insights into risk adjustment calculations, we ensure your compliance journey is efficient and effective. Also if you are struggling with IFRS 9 compliance, do check out our Rust IFRS 9 Software.

Your Trusted Partner for Financial & Risk Management Solutions in the MENA Region