Prima Consulting's IFRS Advisory & Accounting Services help insurers in the Kingdom of Saudi Arabia, UAE, and Pakistan seamlessly transition to IFRS 17.

Our comprehensive services ensure seamless compliance, robust insurance accounting, and strategic advantages for your business.

We perform a comprehensive gap analysis to identify areas where your current practices diverge from IFRS 17 requirements, ensuring a clear roadmap for compliance.

Our experts assist in seamlessly migrating and transforming your existing data to meet IFRS 17 standards, ensuring data integrity and consistency.

We provide end-to-end support for implementing and integrating systems necessary for IFRS 17 compliance, including actuarial and financial reporting systems.

Our actuarial and financial modeling services help you accurately measure insurance liabilities and project future cash flows in line with IFRS 17.

We offer detailed projections of contractual cash flows, ensuring accurate and reliable financial reporting under IFRS 17.

Prima Consulting provides comprehensive training programs to equip your staff with the knowledge and skills to implement and maintain IFRS 17 compliance.

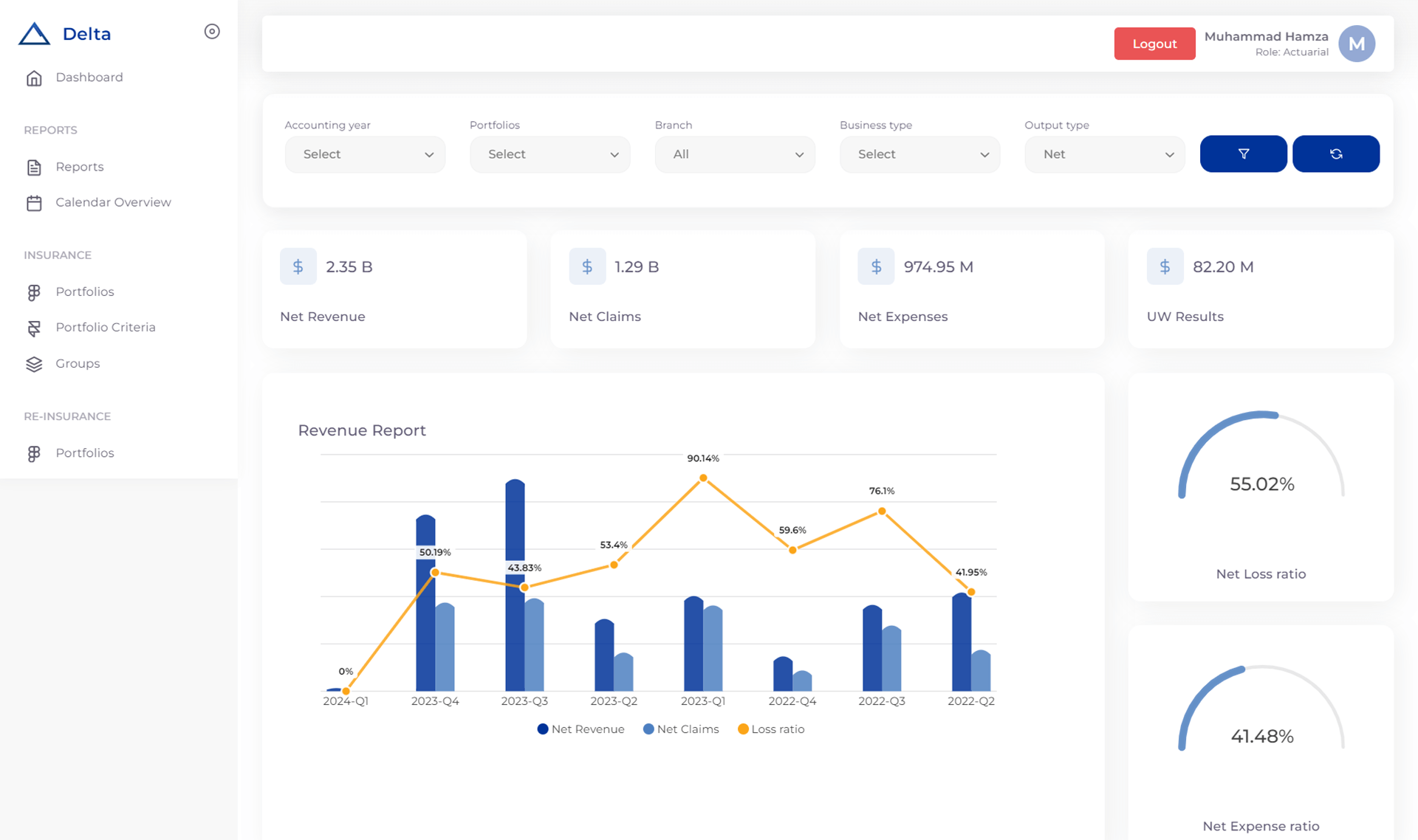

Delta is a cloud-based financial system designed for the insurance industry, ensuring full compliance with IFRS 17.

Our IFRS 17 Software offers robust features for insurance accounting, helping companies meet insurance standards efficiently.

Prima Consulting's Financial & Risk Advisory Services offer a comprehensive suite of solutions empowering businesses across the Middle East and Pakistan to navigate complex financial landscapes.

With a deep understanding of regional challenges and global best practices, we provide tailored solutions to help you achieve your strategic goals.

With over 50 years of combined experience in IFRS Advisory and Accounting Services, we offer a solid foundation for accurate and reliable financial reporting. Our expertise empowers businesses to navigate complex financial landscapes with confidence.

We understand the importance of staying ahead of compliance requirements and industry trends. Our approach is designed to provide you with valuable insights to help you navigate risks and improve your financial health and operational efficiency.

We are here as dedicated partners, wholeheartedly committed to your success. From top management to front-line employees, we provide personalized support and guidance, nurturing a collaborative environment that encourages long-term growth and sustainability.

IFRS 17 is a global accounting standard designed to provide a more comprehensive and transparent view of an insurance company's financial performance.

It introduces a new approach to measuring insurance contracts, focusing on the expected cash flows and uncertainties associated with these contracts.

By aligning revenue recognition with the provision of insurance services, IFRS 17 offers a more accurate and informative picture of an insurer's financial position.

IFRS 17 represents a significant improvement over its predecessor, IFRS 4.

Unlike its predecessor, which provided limited guidance and allowed for diverse accounting practices, IFRS 17 establishes a robust and principles-based framework for insurance contract accounting.

Financial statements' enhanced consistency and comparability are crucial for investors, regulators, and other stakeholders to make informed decisions.

IFRS 17 introduces several fundamental changes to insurance accounting.

Key modifications include adopting a contract-based approach, introducing the Contractual Service Margin (CSM) to represent the unearned profit, and requiring more detailed disclosures.

These changes aim to provide a more accurate reflection of an insurer's financial performance and risk profile.

IFRS 17 mandates a comprehensive approach to accounting for insurance contracts.

It necessitates the recognition of assets, liabilities, income, and expenses related to these contracts.

The standard introduces concepts such as the Contractual Service Margin (CSM), representing the insurer's expected profit from fulfilling its contractual obligations.

Additionally, IFRS 17 requires the consideration of various risk factors and uncertainties in the measurement of insurance liabilities.

The primary objectives of IFRS 17 are to enhance the comparability and relevance of financial information for insurance contracts.

By providing a more consistent and transparent accounting framework, IFRS 17 aims to improve the decision-making capabilities of investors, creditors, and regulators.

The standard also seeks to reduce volatility in reported earnings and provide a more accurate representation of an insurer's financial position and performance.

Implementing IFRS 17 can be complex due to the extensive data requirements, actuarial modeling, and system changes involved.

However, with the right expertise and approach, insurers can effectively navigate the challenges and achieve successful implementation.

Prima Consulting's team of experts can provide invaluable guidance and support throughout the IFRS 17 journey.

An IFRS 17 primer is a foundational resource that provides a high-level standard overview.

It typically outlines the key concepts, requirements, and potential impacts of IFRS 17.

While not a substitute for a comprehensive understanding, a primer can serve as a valuable starting point for insurers embarking on their IFRS 17 implementation journey.

In the context of IFRS 17, a policyholder is a party entitled to receive compensation from an insurer in the event of an insured event.

This definition is crucial for determining the contractual terms and conditions and assessing the insurer's obligations.

IFRS 17 became effective for annual reporting periods beginning on or after January 1, 2023.

However, early adoption was permitted for entities that also adopted IFRS 9. Insurers must have a clear implementation timeline to ensure compliance with the new standard.

Implementing IFRS 17 presents significant challenges for insurers. The transition requires substantial investments in data management, actuarial modeling, and system infrastructure. Key challenges include:

IFRS 17 and GAAP (Generally Accepted Accounting Principles) represent different accounting standards with distinct approaches to insurance contract accounting.

While both aim to provide financial transparency, they exhibit significant differences in measurement, recognition, and disclosure requirements.

While IFRS 17 primarily applies to insurance contracts, it can also impact banks that offer insurance products or embedded insurance within other financial products.

Banks must carefully assess their product portfolios to determine the scope of the IFRS 17 application.

Prima Consulting can help banks evaluate their product offerings and identify the necessary steps to comply with IFRS 17.

Our expertise in the banking and insurance industries enables us to provide tailored solutions for your needs.

Your Trusted Partner for Financial & Risk Management Solutions in the MENA Region