Transform Your IAS 19 Compliance with Ease.

Effortless, Accurate, and Secure Actuarial Valuations to Streamline Employee Benefits Accounting and Ensure Compliance.

Our IAS 19 software stands out due to the dedicated support provided by a team of highly qualified actuaries and accountants, who are always available to assist you.

Their comprehensive assistance spans the entire valuation process and audit, ensuring you receive expert guidance at every stage, from initial assessment to final reporting.

Our suite of tools is meticulously crafted to manage the actuarial valuation of employee retirement benefit liabilities effectively.

It ensures compliance with various financial reporting standards, including AASB 119, FAS 87, Ind AS 19, IAS 19, HKAS 19, and ASPE 3642.

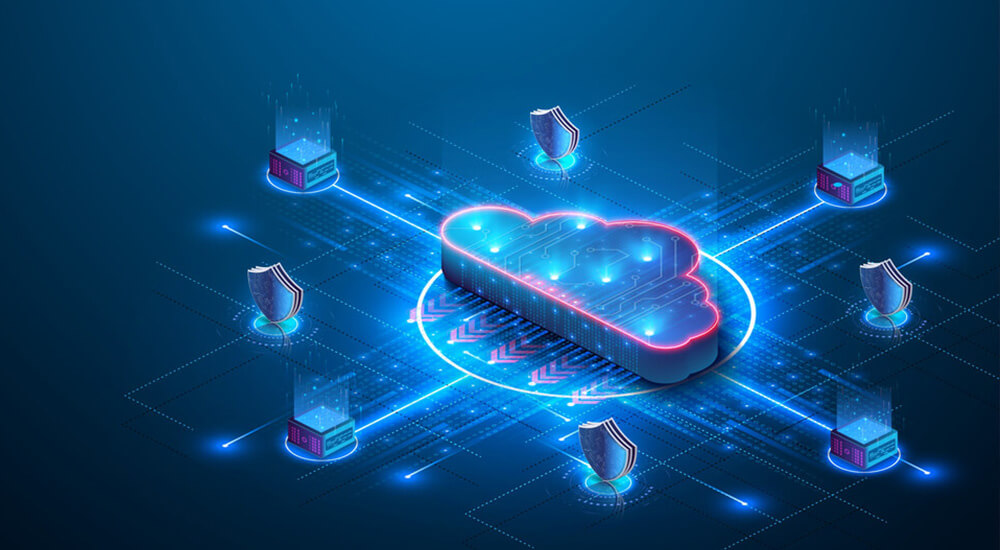

It's always important to keep your confidential employee data secure. Our software provides a safe platform for managing employee data without sharing it with external consultants, ensuring that all information remains within your control.

This enhances privacy and security, giving you peace of mind when handling sensitive information.

Our platform, powered by Oracle Cloud Services, is designed to meet the rigorous standards of Cloud Computing, Regulatory Framework Personal Data Protection Law (PDPL), and Information Technology Commission (CITC) regulations established by the KSA.

Furthermore, it is fully compliant and functional in the UAE, Pakistan, and other regions, allowing widespread use and applicability.

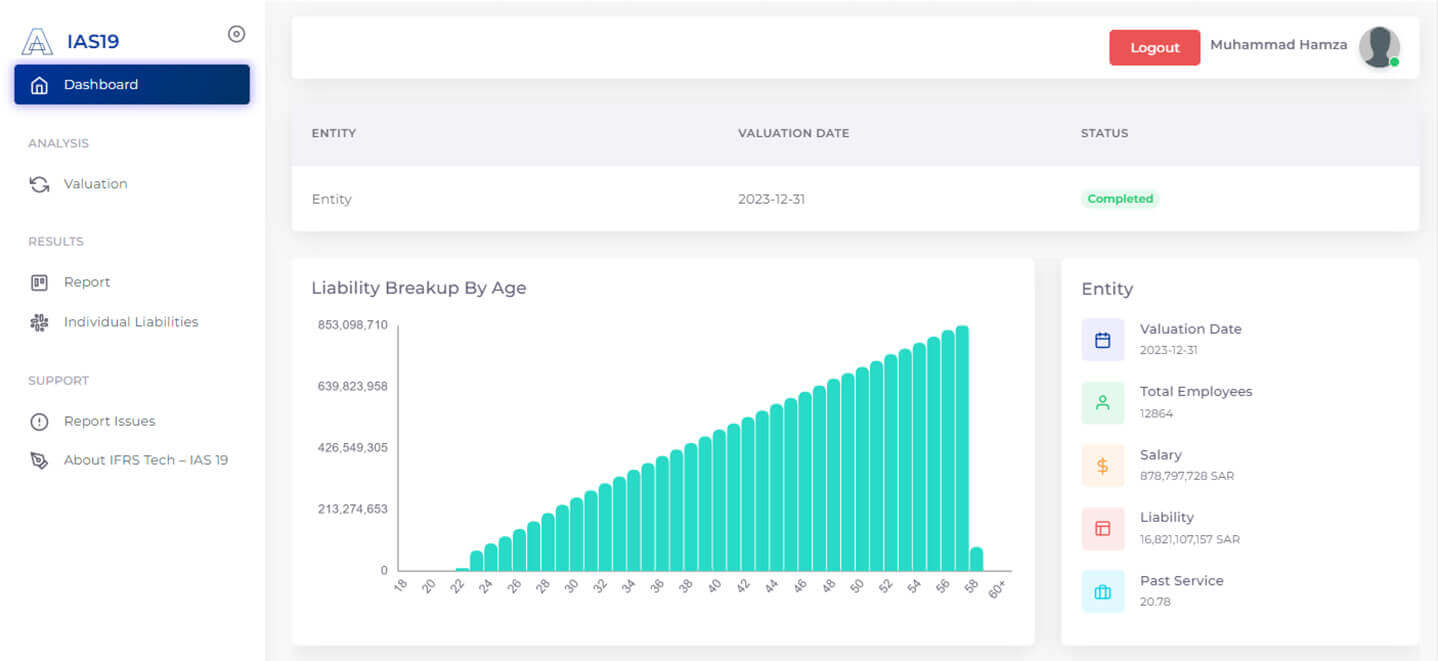

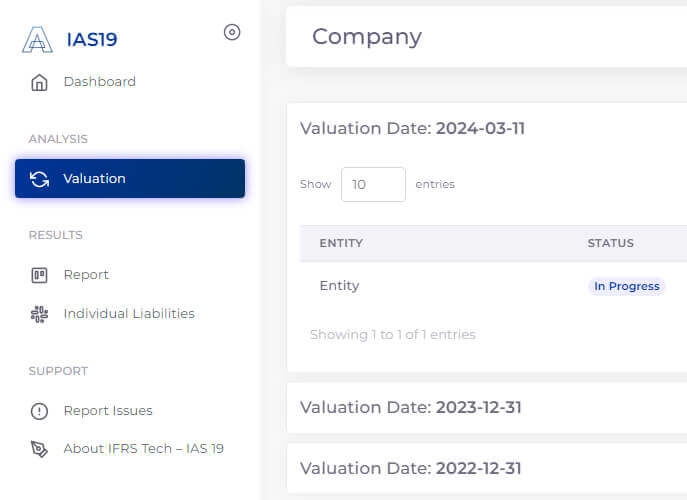

Transform the actuarial valuation process from several months to moments with our efficient system.

Our platform allows you to easily upload your data, customize actuarial assumptions, and instantly generate reports for each reporting entity or unit. Say hello to quick, accurate, and independent actuarial valuation processes.

Our system has been intricately developed to conform to the labor laws of Saudi Arabia and other relevant regulations in the region.

This helps ensure that our system remains compliant and operates effectively not only in Saudi Arabia and the UAE but also in Pakistan and other similar jurisdictions.

IAS 19 is a critical accounting standard that outlines the principles for recognizing and measuring employee benefits liabilities. It covers many benefits, including short-term employee benefits, post-employment benefits like pensions, and termination benefits. Understanding and applying IAS 19 correctly is essential for accurate financial reporting, particularly for organizations with significant employee costs.

An IAS 19 actuarial valuation is a specialized assessment of a company's financial obligations arising from employee benefits promises. It involves complex calculations to determine the present value of these liabilities based on various actuarial assumptions. This valuation is crucial for complying with IAS 19 requirements and clearly showing the company's financial position.

IAS 19 and AS 15 are accounting standards related to employee benefits but differ in their treatment of actuarial gains and losses. While AS 15 allows these gains and losses to be recognized in the profit and loss account, IAS 19 mandates that they be recognized in other comprehensive income (OCI). This distinction significantly impacts a company's financial statements and overall financial performance.

The withdrawal rate in IAS 19 refers to the estimated annual percentage of employees expected to leave the company before retirement. This rate is a crucial factor in calculating employee benefit obligations. It is essential to use accurate and up-to-date withdrawal rates to ensure the reliability of actuarial valuations and financial reporting.

In the context of IAS 19, plan assets represent the resources held by a pension plan or other employee benefit fund that are available to meet future benefit obligations. These assets can include investments, cash, and other financial instruments. Accurate valuation and management of plan assets are vital for effective employee benefits management and financial reporting.

The asset ceiling in IAS 19 represents the maximum amount that can be recognized as an asset related to a defined benefit plan. It is calculated as the present value of expected economic benefits available to the company from the plan. Understanding the asset ceiling is essential for determining the appropriate accounting treatment of plan assets and liabilities.

IAS 19 focuses on the employer's perspective in accounting for employee benefits, while IAS 26 deals with the financial reporting of retirement benefit plans. IAS 19 governs how companies recognize and measure employee benefit costs and liabilities in their financial statements, whereas IAS 26 guides retirement benefit plans on their financial reporting.

A settlement in IAS 19 occurs when a company transfers all or part of its obligations under a defined benefit plan to another party. This typically involves a lump sum payment or creating a separate entity to hold the plan's assets and liabilities. Settlements have significant implications for financial reporting and require careful accounting treatment.

The IAS 19 amendment, "Plan Amendments, Curtailments, and Settlements," introduced changes to the accounting treatment of modifications to employee benefit plans. It provides specific guidance on accounting for plan amendments, curtailments (reductions in benefits), and settlements, ensuring consistency and comparability in financial reporting.

A curtailment in IAS 19 refers to modifying a defined benefit plan that reduces the expected future benefits for current employees. This can occur due to changes in employment terms, plan closures, or other factors. Curtailments have financial implications for the company and require appropriate accounting treatment under IAS 19.

Your Trusted Partner for Financial & Risk Management Solutions in the MENA Region